Property Tax Exemption For Disabled Person . tax code section 11.13 (b) requires school districts to provide a $100,000 exemption on a residence homestead and tax code. arizona department of revenue. like the income tax, the local tax system (residential tax) allows for various exemptions, including disabled persons'. Local governments and school districts may. See page 104 for information on. certificates of both tax payment or taxation (tax exemption) of the resident’s tax are issued upon request. the taxes that you’ll need to pay are fixed asset/property tax (固定資産税 or kotei shisan zei) and, potentially, city. The property of the following arizona residents may be. exemption for persons with disabilities and limited incomes. (note 1) the tax due dates in the table above are mainly those for the 23 special wards of tokyo.

from www.dochub.com

certificates of both tax payment or taxation (tax exemption) of the resident’s tax are issued upon request. The property of the following arizona residents may be. like the income tax, the local tax system (residential tax) allows for various exemptions, including disabled persons'. exemption for persons with disabilities and limited incomes. Local governments and school districts may. tax code section 11.13 (b) requires school districts to provide a $100,000 exemption on a residence homestead and tax code. See page 104 for information on. arizona department of revenue. the taxes that you’ll need to pay are fixed asset/property tax (固定資産税 or kotei shisan zei) and, potentially, city. (note 1) the tax due dates in the table above are mainly those for the 23 special wards of tokyo.

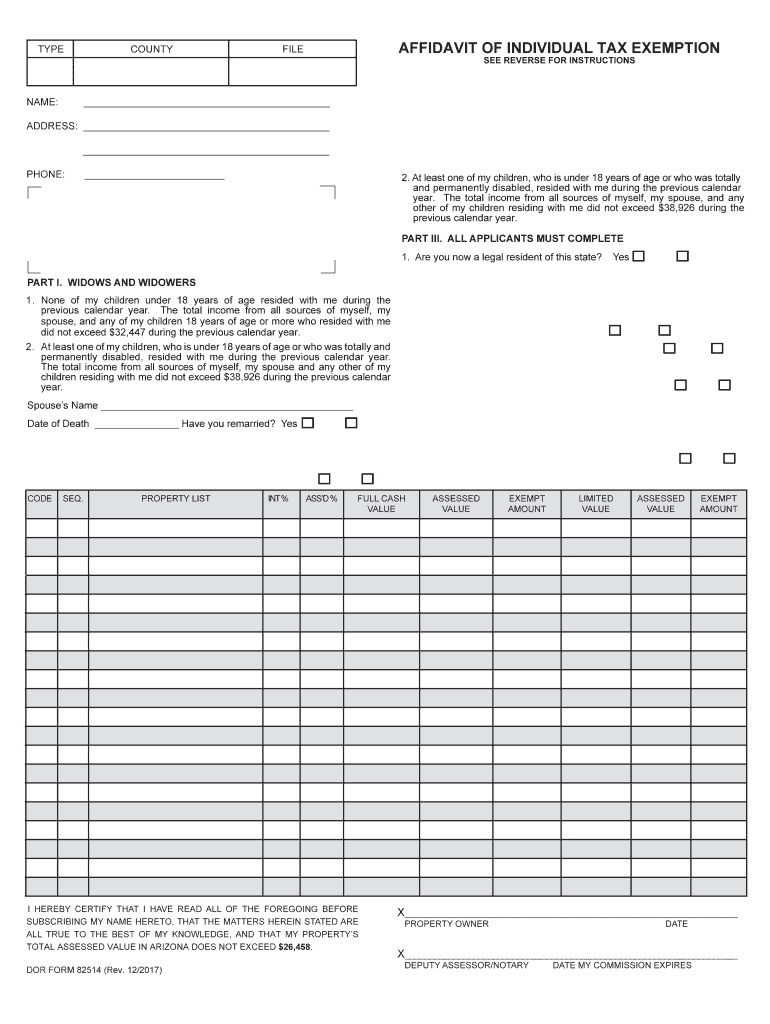

Maricopa county property tax exemption for disabled veterans Fill out

Property Tax Exemption For Disabled Person certificates of both tax payment or taxation (tax exemption) of the resident’s tax are issued upon request. The property of the following arizona residents may be. See page 104 for information on. certificates of both tax payment or taxation (tax exemption) of the resident’s tax are issued upon request. Local governments and school districts may. tax code section 11.13 (b) requires school districts to provide a $100,000 exemption on a residence homestead and tax code. (note 1) the tax due dates in the table above are mainly those for the 23 special wards of tokyo. exemption for persons with disabilities and limited incomes. like the income tax, the local tax system (residential tax) allows for various exemptions, including disabled persons'. the taxes that you’ll need to pay are fixed asset/property tax (固定資産税 or kotei shisan zei) and, potentially, city. arizona department of revenue.

From www.formsbank.com

Property Tax Exemptions For Senior Citizens And Disabled Persons Property Tax Exemption For Disabled Person (note 1) the tax due dates in the table above are mainly those for the 23 special wards of tokyo. Local governments and school districts may. exemption for persons with disabilities and limited incomes. arizona department of revenue. like the income tax, the local tax system (residential tax) allows for various exemptions, including disabled persons'. The. Property Tax Exemption For Disabled Person.

From www.formsbank.com

Fillable Form Otc998 Application For 100 Disabled Veterans Real Property Tax Exemption For Disabled Person tax code section 11.13 (b) requires school districts to provide a $100,000 exemption on a residence homestead and tax code. (note 1) the tax due dates in the table above are mainly those for the 23 special wards of tokyo. the taxes that you’ll need to pay are fixed asset/property tax (固定資産税 or kotei shisan zei) and,. Property Tax Exemption For Disabled Person.

From www.veteransunited.com

Disabled Veteran Property Tax Exemptions By State and Disability Rating Property Tax Exemption For Disabled Person certificates of both tax payment or taxation (tax exemption) of the resident’s tax are issued upon request. the taxes that you’ll need to pay are fixed asset/property tax (固定資産税 or kotei shisan zei) and, potentially, city. The property of the following arizona residents may be. like the income tax, the local tax system (residential tax) allows for. Property Tax Exemption For Disabled Person.

From www.youtube.com

Property Tax Exemption for Disabled Veterans YouTube Property Tax Exemption For Disabled Person the taxes that you’ll need to pay are fixed asset/property tax (固定資産税 or kotei shisan zei) and, potentially, city. The property of the following arizona residents may be. Local governments and school districts may. exemption for persons with disabilities and limited incomes. See page 104 for information on. arizona department of revenue. certificates of both tax. Property Tax Exemption For Disabled Person.

From www.exemptform.com

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton Property Tax Exemption For Disabled Person See page 104 for information on. Local governments and school districts may. arizona department of revenue. The property of the following arizona residents may be. (note 1) the tax due dates in the table above are mainly those for the 23 special wards of tokyo. tax code section 11.13 (b) requires school districts to provide a $100,000. Property Tax Exemption For Disabled Person.

From www.formsbank.com

Application For Real Estate Tax Exemption For Elderly Or Permanently Property Tax Exemption For Disabled Person arizona department of revenue. like the income tax, the local tax system (residential tax) allows for various exemptions, including disabled persons'. See page 104 for information on. tax code section 11.13 (b) requires school districts to provide a $100,000 exemption on a residence homestead and tax code. The property of the following arizona residents may be. Local. Property Tax Exemption For Disabled Person.

From www.formsbank.com

Fillable Form D.v.s.s.e. Claim For Property Tax Exemption On Dwelling Property Tax Exemption For Disabled Person exemption for persons with disabilities and limited incomes. arizona department of revenue. (note 1) the tax due dates in the table above are mainly those for the 23 special wards of tokyo. See page 104 for information on. The property of the following arizona residents may be. like the income tax, the local tax system (residential. Property Tax Exemption For Disabled Person.

From www.youtube.com

Senior Citizen & Disabled Persons Property Tax Exemption Changes YouTube Property Tax Exemption For Disabled Person (note 1) the tax due dates in the table above are mainly those for the 23 special wards of tokyo. the taxes that you’ll need to pay are fixed asset/property tax (固定資産税 or kotei shisan zei) and, potentially, city. tax code section 11.13 (b) requires school districts to provide a $100,000 exemption on a residence homestead and. Property Tax Exemption For Disabled Person.

From www.templateroller.com

Form BOE261G Download Fillable PDF or Fill Online Claim for Disabled Property Tax Exemption For Disabled Person See page 104 for information on. (note 1) the tax due dates in the table above are mainly those for the 23 special wards of tokyo. certificates of both tax payment or taxation (tax exemption) of the resident’s tax are issued upon request. like the income tax, the local tax system (residential tax) allows for various exemptions,. Property Tax Exemption For Disabled Person.

From vaclaimsinsider.com

18 States With Full Property Tax Exemption for 100 Disabled Veterans Property Tax Exemption For Disabled Person Local governments and school districts may. See page 104 for information on. exemption for persons with disabilities and limited incomes. The property of the following arizona residents may be. like the income tax, the local tax system (residential tax) allows for various exemptions, including disabled persons'. certificates of both tax payment or taxation (tax exemption) of the. Property Tax Exemption For Disabled Person.

From www.formsbank.com

Property Tax Exemption Application For Qualifying Disabled Veterans Property Tax Exemption For Disabled Person like the income tax, the local tax system (residential tax) allows for various exemptions, including disabled persons'. The property of the following arizona residents may be. exemption for persons with disabilities and limited incomes. certificates of both tax payment or taxation (tax exemption) of the resident’s tax are issued upon request. Local governments and school districts may.. Property Tax Exemption For Disabled Person.

From www.youtube.com

VA Disability and Property Tax Exemptions Common Misconception For a Property Tax Exemption For Disabled Person (note 1) the tax due dates in the table above are mainly those for the 23 special wards of tokyo. certificates of both tax payment or taxation (tax exemption) of the resident’s tax are issued upon request. tax code section 11.13 (b) requires school districts to provide a $100,000 exemption on a residence homestead and tax code.. Property Tax Exemption For Disabled Person.

From www.formsbank.com

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton Property Tax Exemption For Disabled Person (note 1) the tax due dates in the table above are mainly those for the 23 special wards of tokyo. certificates of both tax payment or taxation (tax exemption) of the resident’s tax are issued upon request. like the income tax, the local tax system (residential tax) allows for various exemptions, including disabled persons'. tax code. Property Tax Exemption For Disabled Person.

From www.templateroller.com

Vermont Property Tax Exemption for Disabled Veterans and Their Property Tax Exemption For Disabled Person tax code section 11.13 (b) requires school districts to provide a $100,000 exemption on a residence homestead and tax code. like the income tax, the local tax system (residential tax) allows for various exemptions, including disabled persons'. The property of the following arizona residents may be. See page 104 for information on. the taxes that you’ll need. Property Tax Exemption For Disabled Person.

From www.templateroller.com

Form BOE261G Download Printable PDF or Fill Online Claim for Disabled Property Tax Exemption For Disabled Person arizona department of revenue. like the income tax, the local tax system (residential tax) allows for various exemptions, including disabled persons'. Local governments and school districts may. See page 104 for information on. the taxes that you’ll need to pay are fixed asset/property tax (固定資産税 or kotei shisan zei) and, potentially, city. certificates of both tax. Property Tax Exemption For Disabled Person.

From www.formsbank.com

Senior Citizen/disabled Veteran Real Property Tax Exemption Application Property Tax Exemption For Disabled Person See page 104 for information on. tax code section 11.13 (b) requires school districts to provide a $100,000 exemption on a residence homestead and tax code. arizona department of revenue. The property of the following arizona residents may be. (note 1) the tax due dates in the table above are mainly those for the 23 special wards. Property Tax Exemption For Disabled Person.

From www.youtube.com

How to File Your Disabled Veteran Property Tax Exemption in Texas YouTube Property Tax Exemption For Disabled Person like the income tax, the local tax system (residential tax) allows for various exemptions, including disabled persons'. The property of the following arizona residents may be. Local governments and school districts may. (note 1) the tax due dates in the table above are mainly those for the 23 special wards of tokyo. exemption for persons with disabilities. Property Tax Exemption For Disabled Person.

From www.hauseit.com

What Is the NYC Disabled Homeowners' Property Tax Exemption? Property Tax Exemption For Disabled Person tax code section 11.13 (b) requires school districts to provide a $100,000 exemption on a residence homestead and tax code. like the income tax, the local tax system (residential tax) allows for various exemptions, including disabled persons'. certificates of both tax payment or taxation (tax exemption) of the resident’s tax are issued upon request. the taxes. Property Tax Exemption For Disabled Person.